Design thinking of Better-Pro AI

In the process of Better-Pro intelligent quantitative trading, the processing and learning capabilities of artificial intelligence are crucial. It can make the trading system more intelligent, accurate and automated, thereby achieving more efficient trading decisions and risk management.

The design principles of the Better-Pro intelligent quantitative trading system are as follows:

Expansion principle: Each module of the Better-Pro intelligent quantitative trading system should be loosely coupled, making it easy to add new modules. The update of each module itself should not require changes in the interfaces of other modules.

Scaling principle: User access to customer products of the Better-Pro Intelligent Quantitative Trading System fluctuates. If a large number of users access a node, the node's service will inevitably collapse, so the node container itself should be automatically deployed. Horizontal expansion can be quickly achieved when user requests are under pressure.

Privacy principle: Investors, computing power nodes, data sources, etc. of Better-Pro intelligent quantitative trading system are all protected by privacy.

High-frequency data low-frequency factor mining framework based on AutoML-Zero

Based on Google's AutoML-Zero algorithm, the AlphaZero framework was constructed by applying it to the field of factor mining. By constructing basic operators and factors, combined with evolutionary algorithms, high-frequency and low-frequency factor mining was carried out. When building AlphaZero, we limited the search space and optimized the operator structure to improve evolutionary efficiency, but on the other hand, we also limited the possibility of the generated program. From the final results, we can also see that the excavated factors also have certain variations based on the classic volume and price factors.

Fundamental factor mining framework based on openFE

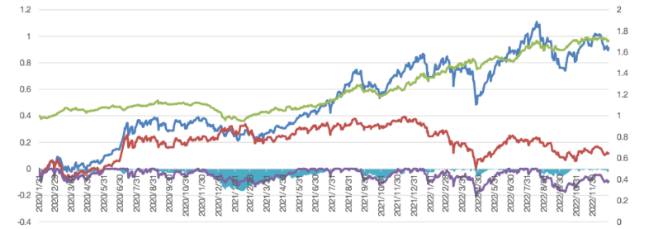

Based on openFE's fundamental factor mining method, the data of the three major reports and basic operators are arranged and combined according to a certain structure to construct 700,000 factors of different styles. Then, openFE's two-step screening method is used to select The best-performing composition factors for different style types. Comparing the performance of factors, momentum, market capitalization, and industry are the most important, followed by valuation and growth factors, and the performance of quality factors is relatively average. Using the constructed synthetic factors and basic factors to train a monthly stock selection model, within the backtest interval, the annualized excess of stock selection in the entire market was 21%, and the Sharpe ratio was 1.19.

For real market applications: The six-dimensional industry rotation model has an excess return rate of 19.06% since it was tracked externally.

Based on the top-down approach, we constructed a six-dimensional comprehensive industry allocation model by combining macro, quantitative fundamentals, financial factors, analyst expectations, institutional preferences, volume and price technology, and capital flow. Since external tracking in 2024, the model's cumulative return rate has been 17.30%, and the industry's equal-weighted excess return is 19.06%.